‘Talent – Employee of a young innovative company’ (JEI)

Thématiques

Date de mise à jour

Nationals of a non-Member State of the European Union, the European Economic Area or Switzerland who whish to stay in France and work for more than three months for a French company must apply for a residence permit.

Specific requirements apply to Algerian citizens.

Various categories of employees holding an employment contract with an employer established in France may be eligible for a multi-year “Talent” residence permit.

Employees recruited by an innovative new company (jeune entreprise innovante – JEI), to undertake a position in connection with the research and development project of this company, may also be granted a “Talent – Qualified Employee” as employee of a young innovative company.

The “Talent – Qualified Employee” residence permit can be delivered to :

- New graduate : skilled employees who hold a diploma earned at an institute of higher learning accredited at the national level at least equivalent to the grade of master or comparable.

- Employee of a JEI or an innovative company : employees recruited by A Young Innovative Company (JEI) or an innovative company recognised by a public body.

- Assigned employee : the employee on assignment hired under a French employment contract by the French company at which the assignment is to be carried out, belonging to the Group of the company that employed them abroad.

Innovative new company (JEI) status

To prove that they hold innovative new company (JEI) status in the taxation regulation sense, prior to recruiting a foreign employee, companies can apply to the Directorate of Public Finance for a rescript certifying that they fulfil the legal criteria entitling them to this status.

The request must be sent by post to the Directorate of Public Finances of the company’s département or region. The tax authorities will subsequently have three months to state their position via an advance tax ruling. Any failure to respond will mean that they implicitly accept and recognize the company’s status as a JEI.

A tax ruling recognizing the employer’s status as a JEI must be enclosed with all applications for a “Talent – Qualified Employee” residence permit as employee of a JEI.

In the absence of such a rescript, the application for JEI status sent to the tax authorities should be attached to long-stay visa and/or residence permit applications.

Form to apply for an advance tax ruling regarding innovative new company (JEI) status

Eligibility

To be eligible, employees of an innovative new company (Jeune Entreprise Innovante – JEI) must have evidence of the following:

- An annual gross salary at least equal to the average annual gross reference salary set by decree, ie €39 582 as of August 31, 2025.

- A permanent employment contract or a fixed-term employment contract for at least three months with an employer established in France.

- An an active participation in the R&D project and development of the company.

- Their employer’s status as an innovative new company (JEI) (i.e., the firm is less than eleven years old, a consolidated workforce of fewer than 250 employees, turnover of less than €50 million).

The multi-year “Talent” residence permit is equivalent to a work permit.

Authorised length of stay

The maximum duration is 4 years, on a renewable basis.

Helpful tip: If the planned length of stay is less than a year, foreign employees will receive a long-stay visa equivalent to a residence permit (‘VLS-TS’) marked “Talent”. The VLS-TS must be validated directly online upon arrival in France via the dedicated platform.

This is valid for up to 12 months. If foreign nationals wish to stay in France beyond this period, they may apply for a four-year “Talent” residence permit.

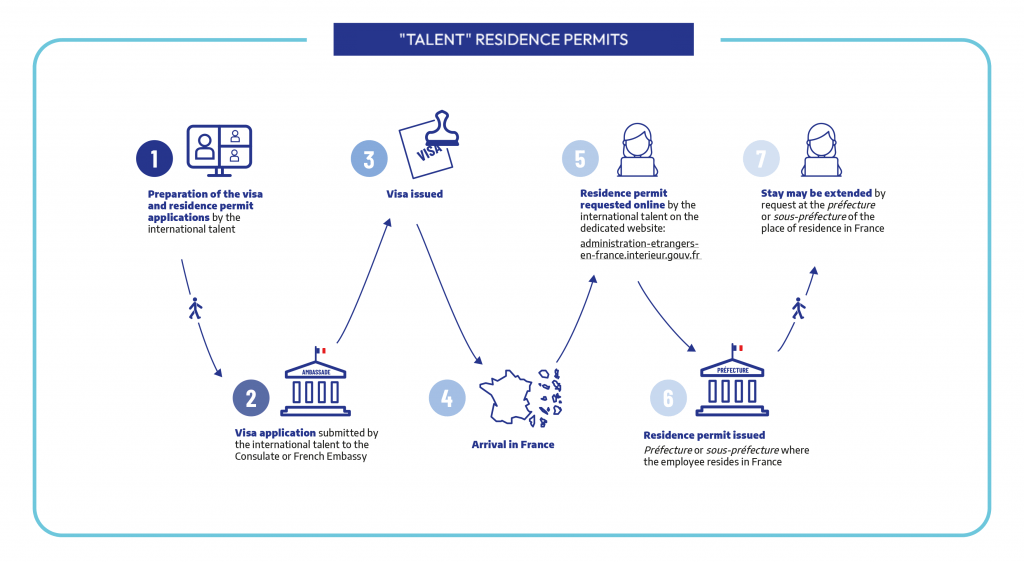

Procedure

Steps

Living outside France

Applicants living outside France should apply to the French consular authorities in their usual place of residence.

The application for a long-stay visa is initiated on the official France-visas website.

The procedure should be initiated no earlier than three months before the date of arrival in France.

Upon arrival in France, the holder will be entitled to work immediately with this visa.

Already living in France

If applicants are already living in France under a different type of residence permit, they will have to apply for a change of status on the dedicated website. They will be asked to prove their eligibility for the desired residence permit.

The procedure should be initiated between 4 to 2 months before the previous residence permit expires.

Between the application and the delivery of the residence permit, the foreign talent can check the status of his or her application on his or her online account, answer to any request to complete his or her file, and check the decisions made.

Documents required

Applicants can obtain a list of exactly which documents are required for a residence permit application from the authority responsible for handling the application and on France-visas.gouv.fr.

As an indication, we provide a list of documents that must be submitted with an application for a “Talent – Qualified Employee” as employee of a young innovative company (JEI).

Cost

Applicants must pay a tax of €100 when the permit is issued. In addition to this tax, stamp duty of €50 is also charged on residence permits. The payment of the tax and the stamp can be validated online.

In addition to this administrative cost of €150, the long-stay visa authorizing entry into France costs €99.

Extending the stay

Renewal

Renewal applications must be submitted between 4 to 2 months before the residence permit expires on the dedicated website.

Applicants must produce documents showing that they continue to meet the conditions of issuance of their permit as well as a certificate of activity from their employer or a certificate of professional activity for the last 12 months uploaded by the employee to the website mesdroitssociaux.gouv.fr.

Administrative cost: €150

Change of status

In the event of a change in the professional situation of the talent, a change of status may be considered 4 to 2 months before the expiration of the residence permit on the dedicated platform in the case of an application for a “Talent” residence permit or at the Prefecture for any other type of residence permits of his or her place of residence. It will be necessary to meet the eligibility requirements of the new residence permit requested.

Residence card

At the end of 5 years of legal and uninterrupted residence in France, workers in this category may apply for the resident card entitling the bearer to reside on French soil and engage in any professional activity (provide they hold the necessary diplomas, if working in a regulated professions).

Residence cards are issued for 10 years on a renewable basis.

Accompanying

The spouse and dependent minor children of the holder of a “Talent” permit have accompanying family status.

The spouse should apply, and will be issued with a “Talent – Family” residence permit. This permit authorizes the family to stay and undertake any paid employment in France as long as the foreign employee’s residence permit is valid.

Administrative cost: €150 for the spouse’s residence permit and €99 per visa issued to each member of the accompanying family.