Moving to France? Impacts on Social protection

Thématiques

Date de mise à jour

Throughout your stay in France, regardless of its duration, you must be covered by a social protection system.

A foreign employee who works and resides in France is, in principle, subject to French social protection legislation, irrespective of their nationality and the country in which their employer is registered. The French social security system is not only protective and generous, it also offers extremely wide social security coverage.

Seconded employees

Employees posted in France by their original employer can continue to be affiliated to the social security system of their source country if a social security agreement is in place between the country in which the company is based and France.

An employee is considered to have been seconded when their employer is registered outside France and entrusts them with a temporary assignment that must be carried out on French territory. The employment contract that seconded employees have with their foreign-based employer remains valid throughout the posting period.

These employees remain subordinate to their original employer, who continues to instruct them and retains the power to oversee the execution of their assignment or take disciplinary action should they fail to meet their professional obligations.

As regards employment law, employers (and contracting parties) must comply with the regulations applicable to all workers in France (minimum wage, overtime compensation, legal working time, workplace health and safety legislation, etc.)

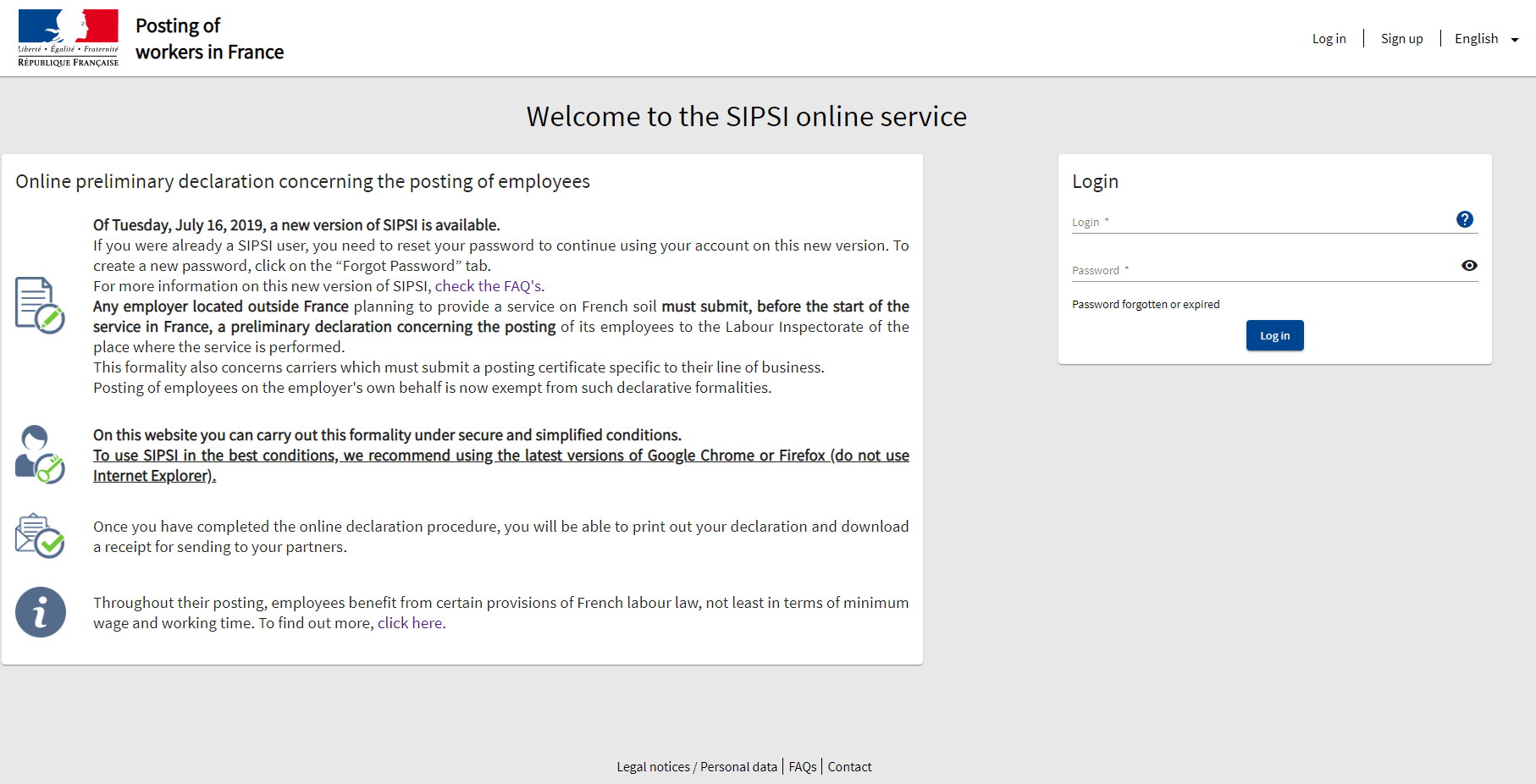

When an employee is posted in France, regardless of their nationality, a secondment declaration must be submitted by their foreign-based employer using the online “Sipsi” service provided by the Ministry for Labour.

Employee secondment is covered by French employment law in the following cases:

- Provision of services.

- Intragroup mobility.

- Provision of personnel on a temporary basis.

- Operations on own account.

Any posting to France, regardless of the employee’s nationality, must be the subject of a prior posting declaration by the employer based abroad, using the “Sipsi” teleservice of the Ministry of Labor. SIPSI Teleservice