Stock options (SO)

Stock options (share purchase or subscription options) allow employees and certain company representatives to subscribe for, or purchase, over a fixed period of time, shares in their company or in a group company at a price set in advance. This system also applies to stock options granted by non-French issuing companies[1]. In practice, this specific share scheme is often offered to the company’s senior executives.

The advantage for the employee or manager is that they can acquire, on the day the option is exercised2, shares at a lower price than the market price. When the employee or manager exercises the option and pays the price, he or she becomes a shareholder and thus realizes an acquisition gain (difference between the value of the shares on the day the option is exercised and the price paid). The taxation of this acquisition gain is deferred until the year the shares are sold.

When selling the shares, the employee then realises a gain (capital gain) or a loss (capital loss) on the sale (difference between the sale price of the shares and their value on the exercise date). This capital gain is taxed for the year in which the sale of the shares takes place. If there is a capital loss on disposal, it will be deducted from the exercise gain for the year and will reduce its taxable base.

On the company’s side, the social security contribution costs may be reduced to 7.5% of the value of the shares on the day of the allocation decision3. This employee profit-sharing tool is therefore attractive compared with traditional remuneration.

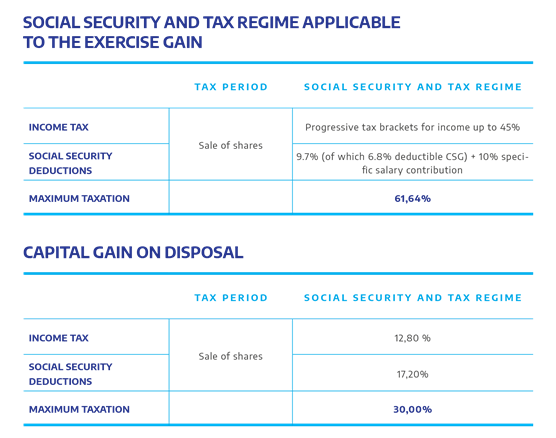

<< The social and tax regime applicable to stock option allocations is as follows

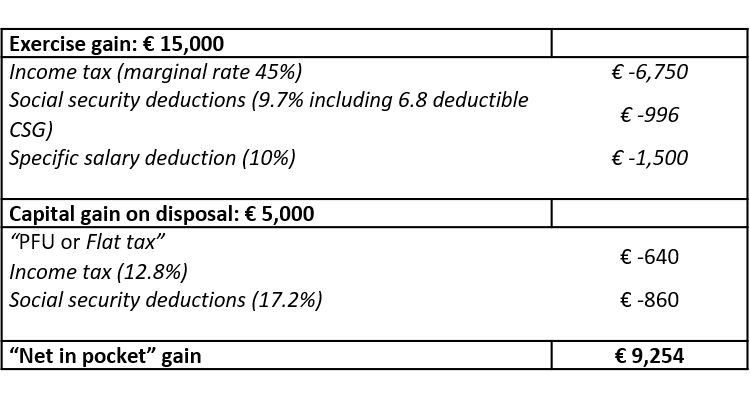

Example:

Mr Miyamoto is an employee of company Y.

On March 15, 2018, he received an allocation of 1,000 stock options from company Y, the exercise price of which was set at €15 per share.

On March 15, 2020, Mr Miyamoto exercised the option and paid the exercise price for all 1,000 shares in company Y. On this date, the unit value of the share set at €30 generated an acquisition gain of (€30 – €15) x 1,000 = €15,000.

On April 15, 2020, Mr Miyamoto sold his 1,000 shares for a unit sale price of €35. He therefore received a total amount of €35,000 and made a gain (capital gain on disposal) of €5,000 (€35,000 – €30,000).

Calculation of Mr Miyamoto’s “net in pocket” gain >>

1 Subject to compliance with certain conditions, in particular the adaptation of the conditions of the foreign plan to the provisions of the French Commercial Code.

2 Mechanism by which the beneficiary of an option declares his or her wish to become a shareholder by paying the option exercise price.

3 The employer’s contribution is calculated at the employer’s discretion (i) either on the fair value of the options as estimated for the preparation of the consolidated financial statements for companies applying international accounting standards, (ii) or on 25% of the value of the shares on the date of the allocation decision. This choice is exercised by the employer for the duration of the financial year for all the share subscription or purchase options that it allocates.