Non-residents, declare your income

Thématiques

Date de mise à jour

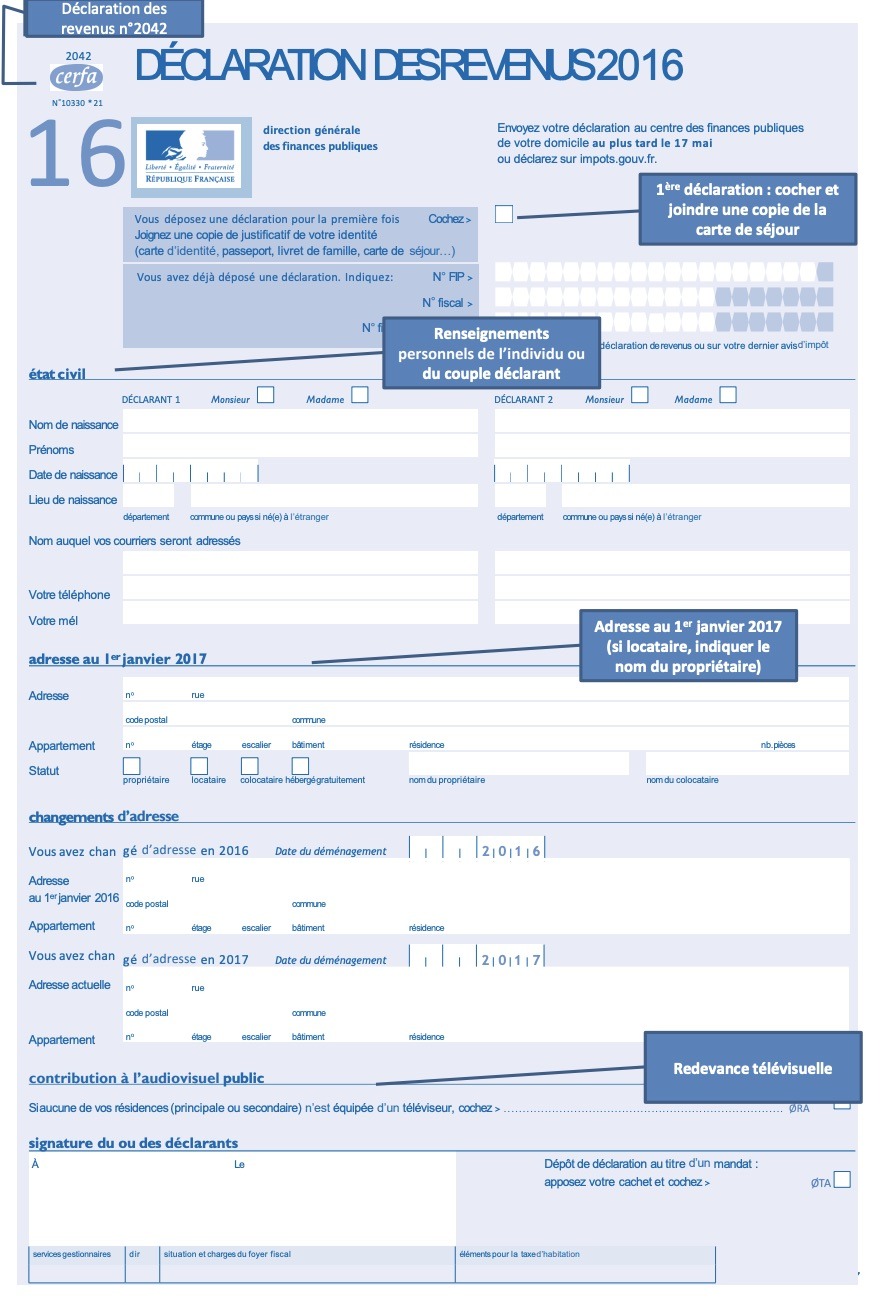

Persons not domiciled in France for tax purpose but with income from French sources must declare this income using Cerfa form no. 2042.

This declaration must be sent to the Tax department for non-residents.

While income from French sources is taxable in principle, tax agreements signed between France and the country of origin are intended to prevent the same income being taxed twice.

View the list of international tax treaties signed by France

To avoid double taxation, withholding tax collected in France gives rise to an equivalent tax credit in the country of residence.

* depending on the tax treaty between France and the country of residence

How to fill out your first tax return

Tax department for non-residents

For any question related to your personal tax situation, the Non-Resident Individual Tax Department is available to individual users:

- By phone at +33 (0) 1 72 95 20 42 from Monday to Friday from 9am to 4pm.

- By e-mail via the personal account on impots.gouv.fr.

- By mail to the following address: 10 rue du Centre, TSA 10010, 93465 Noisy-Le-Grand Cedex.

Professional users can also call a dedicated telephone number: +33 (0) 1 72 95 20 31 from Monday to Friday from 9am to 4pm. They can also send their questions by mail to the following address: 10 rue du Centre, TSA 20011, 93465 Noisy-Le-Grand Cedex