Business creator share subscription warrants (BSPCE)

Business creator share subscription warrants (BSPCE) enable companies, particularly start-ups created less than fifteen years ago, to offer their employees and certain managers the right to subscribe for shares at a price set in advance.

Since January 1, 2020, a foreign company may offer BSPCEs to employees of its French subsidiary. The allocation must be carried out under the same conditions as if it were done by a company established in France – conditions related to the company and the beneficiary as well as the terms of allocation.

For the company, the allocation of BSPCEs is attractive as it does not lead to any specific employer social contribution.

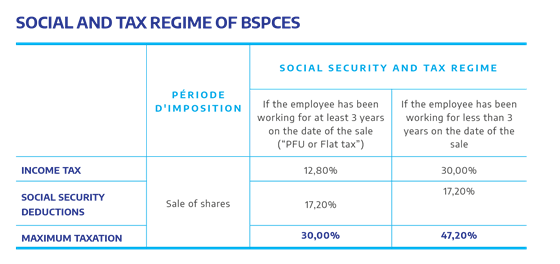

For the beneficiary of BSPCEs, the tax regime is as follows – the gain realised on the sale of the shares is equal to the difference between the sale price of the shares and the acquisition price. It is taxed under the following conditions >>

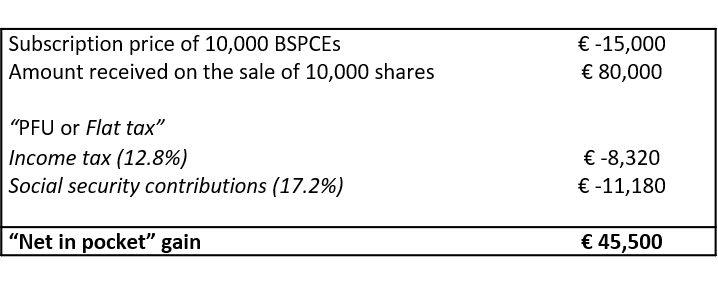

Example:

Ms Smith has been an employee of company Y since its creation in 2014.

On March 15, 2015, she received an award of 10,000 BSPCEs from company Y, the exercise price of which was set at €1.50 per share.

On March 15, 2020, Ms Smith paid the subscription price and received all 10,000 shares in company Y. She sold the 10,000 shares on the same day at a unit sale price of €8. She therefore received a total amount of €80,000 and achieved a net gain of €65,000 (€80,000 – €15,000).