Restricted Stock Units (RSU or AGA)

26

Restricted Stock Units is used to retain employees and certain company representatives by offering them the opportunity to become shareholders of the company free of charge at the end of a fixed period set in advance and after a minimum holding period for the shares. The definitive acquisition of shares may be subject to conditions of presence and/or performance in the company. AGAs are a common profit-sharing tool and therefore target a broad population within the company.

The company sets the conditions and the period after which the employee becomes the owner of the shares, free of charge. This period of time, known as the acquisition period, is at least one year. The company may also apply a minimum retention period to the shares. In all cases, the cumulative acquisition and holding periods may not be less than 2 years.

This system also applies to grants made by non-French issuing companies to employees and managers who carry out their activity in one of the group’s companies (parent company or subsidiary)[1].

Initially, at the end of the acquisition period, the employee becomes a shareholder and makes an acquisition gain equivalent to the value of the shares that were acquired free of charge. However, the taxation of the acquisition gain is postponed to the year in which the employee sells the shares.

Subsequently, at the end of the holding period of the shares, if the employee sells them, he/she makes a gain (capital gain) or a loss (capital loss) equal to the difference between the sale price (sale) of the shares and their value on the date of their acquisition. This capital gain is taxed during the year in which the sale of the shares takes place. If there is a capital loss on disposal, it will be deducted from the acquisition gain and will reduce the taxable base.

On the employer side, the social security contributions costs[2] of this employee share scheme are also attractive (specific social contribution of 20% based on the value of the shares upon vesting) compared with remuneration in salary which is subject to higher costs.

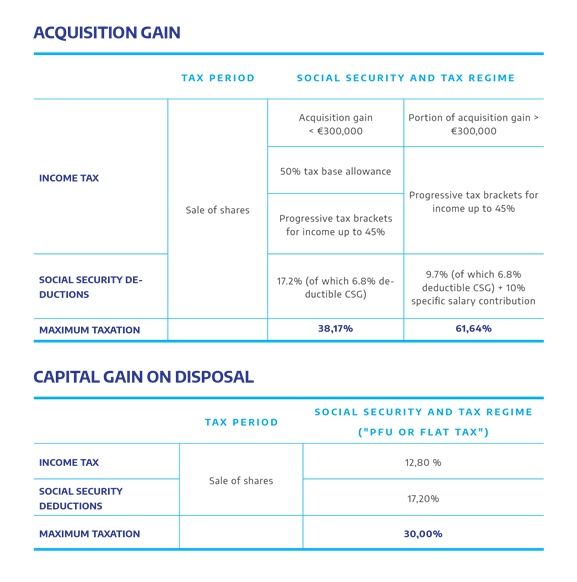

<< For the beneficiary, the social and tax regime applicable to the allocation of free shares since January 1, 2018 is as follows.

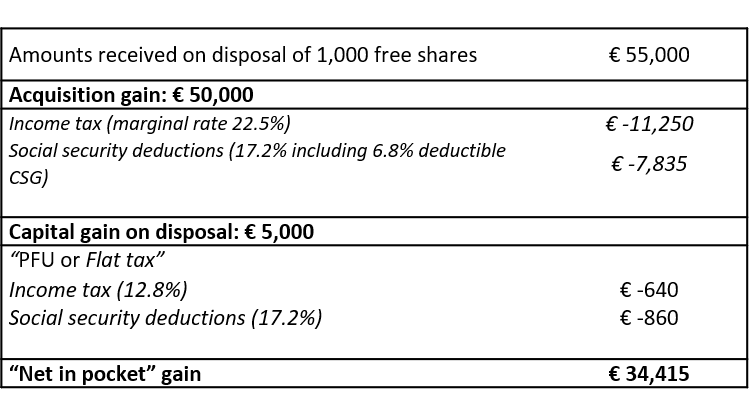

Example:

Mr Anderson is an employee of company Y.

On March 15, 2018, he received an allocation of 1,000 free shares.

On March 15, 2020, Mr Anderson definitively acquired the 1,000 shares of company Y free of charge. On this date, the unit value of the share was €50. The acquisition gain made on March 15, 2020 is therefore equal to €50,000.

On April 15, 2020, he sold his 1,000 shares for a unit price of €55. He therefore received a total amount of €55,000 and realised a capital gain on disposal of €5,000 (€55,000 – €50,000).

Calculation of Mr Anderson’s “net in pocket” gain >>

[1] Subject to compliance with certain conditions, in particular the adaptation of the conditions of the foreign plan to the provisions of the French Commercial Code.

[2] Regime applicable to Restricted Stock Units granted under the conditions of the French Commercial Code and authorised by a decision of the shareholders’ meeting since January 1, 2018.